The Macaulay Duration

Intro

The History of Duration In 1938, economist Frederick Macaulay suggested duration as a way of determining the price volatility of bonds. ‘Macaulay duration’ is now the most common duration measure. Until the 1970s, few people paid attention to duration due to the relative stability of interest rates. When interest rates began to rise dramatically, investors became very interested in a tool that would help them assess the price volatility of their fixed income investments.

Macaulay Duration, is a measure of how long it takes for the price of a bond to be repaid by the cash flows from it. In layman terms, it is the time an investor would take to get back all his invested money in the bond by way of periodic interest as well as principal repayments. The Macaulay duration for a portfolio is calculated as the weighted average time period over which the cash flows on its bond holdings are received. It is measured in years. The Macaulay Duration of a debt fund is nothing but the weighted average Macaulay Duration of the debt securities in the portfolio.

How it works (Example):

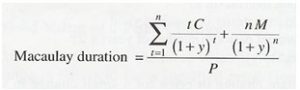

The formula can be describe as:

Where:

t = period in which the coupon is received

C = periodic (usually semiannual) coupon payment

y = the periodic yield to maturity or required yield

n = number periods

M = maturity value (in $)

P = market price of bond

The formula is complicated, but it boils down to: Duration = Present Value of a bond’s cashflows, weighted by length of time to receipt/ bond’s current market value.

For example, let’s calculate the duration of a three-year $1,000 Company XYZ bond with a semiannual 10% coupon.

Table 1. Macaulay Duration Calculation

Table 1. Macaulay Duration Calculation

Notice in the table above that we first multiplied the cash flows by the periods in which they occurred and then calculated the present value of each of these weighted cash flows.

To calculate the Macaulay Duration, we then divide the sum of the present values of these cash flows by the current bond price (which we are assuming is $1,000):

Company XYZ Macaulay Duration = $5,329.48 / $1,000 = 5.33

Duration can help investors understand how sensitive a bond is to changes in prevailing interest rates. By multiplying a bond’s duration by the change, the investor can estimate the percentage price change for the bond. For example, consider the Company XYZ bonds with a duration of 5.33 years. If for whatever reason market yields increased by 20 basis points (0.20%), the approximate percentage change in the XYZ bond’s price would be:

-5.33 x .002 = -0.01066 or -1.066%

Note that this is an approximation. The formula assumes a linear relationship between bond prices and yields (that is, they always change by the same degree) even though the relationship is actually convex (meaning that when one changes, the other changes but to varying degrees). Thus, the formula is less reliable when there is a large change in yield.

In general, six things affect a bond’s duration:

- Bond’s Price: Note that if the bond in the above example were trading at $900 today, then the duration would be $5,329.48 / $900 = 5.92. If the bond were trading at $1,200 today, then the duration would be $5,329.48 / $1,200 = 4.44.

- Coupon: The higher a bond’s coupon, the more income it produces early on and thus the shorter its duration. The lower the coupon, the longer the duration (and volatility). Zero-coupon bonds, which have only one cash flow, have durations equal to their maturities.

- Maturity: The longer a bond’s maturity, the greater its duration (and volatility). Duration changes every time a bond makes a coupon payment. Over time, it shortens as the bond nears maturity.

- Yield to Maturity: The higher a bond’s yield to maturity, the shorter its duration because the present value of the distant cash flows (which have the heaviest weighting) become overshadowed by the value of the nearer payments.

- Sinking Fund: The presence of a sinking fund, which is a scheduled prepayment of the bond before it matures, lowers a bond’s duration because the extra cash flows in the early years are greater than those of a bond without a sinking fund.

- Call Proivisions: Bonds with call provisions also have shorter durations because the principal is repaid earlier than a similar non-callable bond.

Summary

By understanding the duration you can more effectively structure the interest rate sensitivity of your portfolio as it relates to your overall investment objectives and risk tolerance. However, duration is only one factor among many to be considered in determining whether a given security is right for your portfolio. Duration is only meant to describe the interplay between a security’s price and prevailing interest rates, and does not give any indication regarding an issuer’s ability to make interest and principal payments in a timely fashion. A security’s duration is only an estimate, and the change in price in response to an interest rate change may be more or less than indicated by the security’s duration. As with any investment consideration, a security with a given duration may be appropriate for one investor but not another.

Refferences :

https://www.thehindubusinessline.com/opinion/columns/slate/all-you-wanted-to-know-about-macaulay-duration/article24137418.ece

https://www.blackrock.com/fp/documents/understanding_duration.pdf

https://investinganswers.com/financial-dictionary/bonds/macaulay-duration-5079

Great share, by understanding this concept, interest to bonds in Indonesia will be high while the government offering bonds in 2019.

interesting article, thanks bro devid for the sharing. It give me more information how to calculate the durations of bonds with Macaulay method, besides Modified duration method.

It’s interesting article, giving the information about time for investor would take to get back all his invested money in the bond. Thank you for sharing.

thanks bun, seems like you have interest to buy a bond hehe

actually modified duration is a modification from macaulay duration. maybe i will explain it in the next article. thanks for comment sam

hi grace thanks for the comment tho. i hope it will be useful if you want to make a bond investment decision hehe

Great article Devid, i have question, does six things affect a bond’s duration rule still apply when economic recession or depression is happened in a country?

Thank you for sharing mas devid! This is really a good article

interesting article devid, thank you for providing insight about Macaulay Duration

Nice sharing Mas David..!!even tough duration is only one of variable to describe security of price vs interest, but this does really helpful..thanks

Thanks for share this article… classic concept, but very interesting. Gold!