Understanding Risk and Return Relationship

In most important business decisions there are two key financial considerations: risk and return. Each financial decision presents certain risk and return characteristics, and the combination of these characteristics can increase or decrease a firm’s share price. Analysts use different methods to quantify risk, depending on whether they are looking at a single asset or a portfolio (a collection or group of assets).

In investing, risk and return are highly correlated. Increased potential returns on investment usually go hand-in-hand with increased risk. Different types of risks include project-specific risk, industry-specific risk, competitive risk, international risk, and market risk. Return refers to either gains and losses made from trading a security.

DEFINITION

Risk

A measure of the uncertainty surrounding the return that an investment will earn or, more formally, the variability of returns associated with a given asset. The dictionary definition of risk is the chance that an investment’s actual return will be different than expected. Risk means you have the possibility of losing some, or even all, of your original investment. Low levels of uncertainty (low risk) are associated with low potential returns. High levels of uncertainty (high risk) are associated with high potential returns. The risk/return trade off is the balance between the desire for the lowest possible risk and the highest possible return

Return

The return on an investment is expressed as a percentage and considered a random variable that takes any value within a given range. Several factors influence the type of returns that investors can expect from trading in the markets. If the investor are going to assess risk on the basis of variability of return, they need to be certain to know what return is and how to measure it.

Total Rate of Return

The total gain or loss experienced on an investment over a given period of time; calculated by dividing the asset’s cash distributions during the period, plus change in value, by its beginning-of- period investment value. The sum of cash distributions, such as interest or dividends, plus the change in the asset’s value over a given period, divided by the investment’s beginning-of-period value.

UNDERSTANDING THE RISK AND RETURN

Risk Preference

Different people react to risk in different ways. Economists use three categories to describe how investors respond to risk :

- Risk Averse : The attitude toward risk in which investors require an increased return as compensation for an increase in risk

- Risk Neutral : The attitude toward risk in which investors choose the investment with the higher return regardless of its risk.

- Risk Seeking : The attitude toward risk in which investors prefer investments with greater risk even if they have lower expected returns.

Risk of Single Asset : Risk Assessment

The notion that risk is somehow connected to uncertainty is intuitive. The more uncertain you are about how an investment will perform, the riskier that investment seems. Scenario analysis provides a simple way to quantify that intuition, and probability distributions offer an even more sophisticated way to analyse the risk of an investment.

- Scenario Analysis : An approach for assessing risk that uses several possible alternative outcomes (scenarios) to obtain a sense of the variability among returns. The range is found by subtracting the return associated with the pessimistic outcome from the return associated with the optimistic outcome. The greater the range, the more variability, or risk, the asset is said to have.

- Probability Distributions : A model that relates probabilities to the associated outcomes. Provide a more quantitative insight into an asset’s risk. The probability of a given outcome is its chance of occurring. An outcome with an 80 percent probability of occurrence would be expected to occur 8 out of 10 times. An outcome with a probability of 100 percent is certain to occur. Outcomes with a probability of zero will never occur.

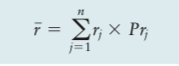

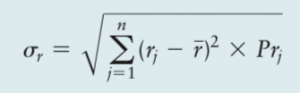

Risk Measurement

In addition to considering the range of returns that an investment might produce, the risk of an asset can be measured quantitatively by using statistics. The most common statistical measure used to describe an investment’s risk is its standard deviation.

- Standard Deviation : The most common statistical indicator of an asset’s risk; it measures the dispersion around the expected return.

where :

- rj = return for the jth outcome

- Prj = probability of occurrence of the jth outcome

- n = number of outcomes considered

In general, the higher the standard deviation, the greater the risk.

- Coefficient of Variation -> Trading Off Risk and Return : A measure of relative dispersion that is useful in comparing the risks of assets with differing expected returns.A higher coefficient of variation means that an investment has more volatility relative to its expected return. Because investors prefer higher returns and less risk, one might intuitively expect investors to gravitate towards investments with a low coefficient of variation

Risk of A Portfolio

Each investment carries a risk of loss. The higher the potential returns, the higher the risk. If you hold a portfolio with many investments, each of those investments carries its own risk. All of the investment risks combined result in an overall risk you have exposed your portfolio to.

- Correlation : A statistical measure of the relationship between any two series of numbers. If two series tend to vary in the same direction, they are positively corre- lated. If the series vary in opposite directions, they are negatively correlated

- Diversification : To reduce overall risk, it is best to diversify by combining, or adding to the port- folio, assets that have the lowest possible correlation. Combining assets that have a low correlation with each other can reduce the overall variability of a portfolio’s returns. If some asset are uncorrelated; that is, there is no interaction between their returns. Combining uncorrelated assets can reduce risk, not as effectively as com- bining negatively correlated assets but more effectively than combining positively correlated assets.

- In general, the lower the correlation between asset returns, the greater the risk reduction that investors can achieve by diversifying. The following example il- lustrates how correlation influences the risk of a portfolio but not the portfolio’s expected return.

How Diversification Reduces or Eliminates Firm-Specific Risk

- First, each investment in a diversified portfolio represents only a small percentage of that portfolio. Thus, any risk that increases or reduces the value of that particular investment or group of investments will only have a small impact on the overall portfolio.

- Second, the effects of firm-specific actions on the prices of individual assets in a portfolio can be either positive or negative for each asset for any period. Thus, in large portfolios, it can be reasonably argued that positive and negative factors will average out so as not to affect the overall risk level of the total portfolio.

The benefits of diversification can also be shown mathematically:

σ^2portfolio= WA^2σA^2 + WB^2σB^2 + 2WA WBр ABσ AσB

Where:

- σ = standard deviation

- W = weight of the investment

- A = asset A

- B = asset B

- р = covariance

Other things remaining equal, the higher the correlation in returns between two assets, the smaller are the potential benefits from diversification.

SUMMARY

Investment returns vary both over time and between different types of investments. Investors may be risk averse, risk neutral, or risk seeking. Most financial decision makers are risk averse. A risk-averse decision maker requires a higher expected return on a more risky investment alternative. In the investing world, risk refers to the chance that an investment’s actual return will differ from the expected return – the possibility that an investment won’t do as well as you’d like, or that you’ll end up losing money. The most effective way to manage investing risk is through diversification. Although diversification won’t ensure gains or guarantee against losses, it does provide the potential to improve returns based on your target level of risk. Finding the right balance between risk and return helps ensure you achieve your financial goals

Source:

- Gitman, Lawrence J., and Chad J. Zutter. Fourteenth Edition. Principles of Managerial Finance

- http://www.businessmanagementideas.com/investment/risk-and-return-investment/

- https://corporatefinanceinstitute.com/resources/knowledge/trading-investing/risk-and-return/

- https://www.investopedia.com/walkthrough/corporate-finance/4/capital-markets/risk-returns.aspx

good article. Tell me about risk variety that i’ve been not known before 🙂

Great article, for me as newbie on investment

Thank you for sharing this article, it helps me to understand more about risk and return

Thanks .. hopefully it’s useful and we can invest more comfortably in the future

Thanks, keep the spirit high to continue investing for the future

Nice Post, make me more educated about Risk and Retune in investment 😀

Nice, helpful references for beginner as myself….

Your welcome grace.. hopefully useful for your future investment

Thanks, hopefully it can be applied when you planning for invest

thanks.. beginners are usually eager to continue learning,, keep investing for the future

Nice share, it is very important to know about risk and return in investment. Keep up the good work!

High risk, high return… Thanks for the article mbak..

thanks, happy investing!

your welcome , dhaif… enjoyed

Good article mrs.. helpful references for investors..

It’s interesting article, we can learn more about the risk from investment and how to handle it. Thank you for sharing.

Nice article shandy, but i have question, if a company who has many different project and subsidiaries, and it has determined its hurdle rate as required rate of return, could the hurdle rate apply for its all projects and subsidiaries?

thank you din.. enjoyed

your welcome gracy.. hopefully this article will help you for your future investing

thanks for the question, as far as i know, A hurdle rate, which is also known as minimum acceptable rate of return (MARR), is the minimum required rate of return or target rate that investors are expecting to receive on an investment. The rate is determined by assessing the cost of capital, risks involved, current opportunities in business expansion, rates of return for similar investments, and other factors that could directly affect an investment. In order for a project to be accepted, its internal rate of return must equal or exceed the hurdle rate so its can apply all project and subsidiaries.

sorry if there is a mistake, note still learning

hopefully satisfied with the answer 😀