Assets: Return, Turnover, and Profit in Between

Assets, such as property and equipment, are valuable items for a company. They can be owned or leased in order for the firm to operate. Assets are important because they can generate revenue, increase the company net worth, and facilitate the operation of the business. They can also be sold or transferred to lower the tax bill and improve the efficiency of the firm. The management of assets is recorded in the company balance sheet. It can show the profitability and financial position of the business, assure shareholders, and attract investors. Identifying and valuing the assets are vital in determining the net worth of the company.

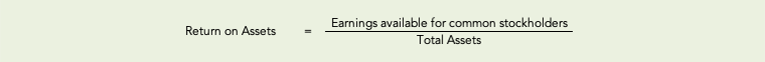

Regarding assets and financial analysis, the return on total assets (ROA) is one of the key performance indicators. It measures the overall effectiveness of management in producing profits by utilizing its available assets. Few companies perform well over time without achieving a fair score in this essential calculation. Thus, the higher the value, the better. To measure ROA, the formula is as below.

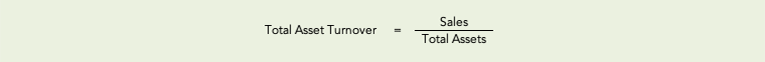

However, return on assets is a very limited indicator because it depends on the context. Therefore, it should be assessed using other calculations. Based on the DuPont method, ROA can actually be affected by total asset turnover and net profit margin. The total asset turnover indicates the efficiency with which the firm uses its assets to generate sales. It is calculated as below.

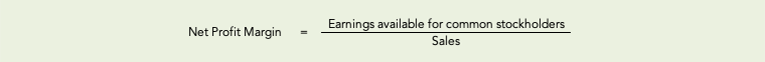

While ROA attracts more attention from the investors, total asset turnover is probably of greatest interest to management because it indicates whether the firm’s operations have been financially efficient. The other affecting value to ROA is the net profit margin. NPM measures the percentage of each sales dollar remaining after all costs and expenses, including interest, taxes, and preferred stock dividends, have been deducted. The formula is as follow.

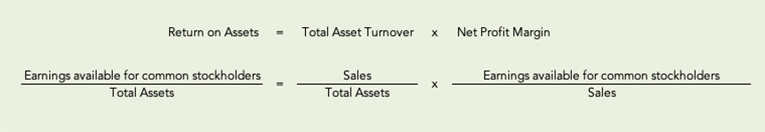

Knowing both calculations, it can be computed that,

Therefore, it works the same for all calculations that the higher the value, the better it is for the company.

Then, how about companies that have a low net profit margin? Does that mean they are also low in ROA? Does that mean they are not profitable? Well, not necessarily. Companies, such as Walmart and Target have a low net profit margin. However, they have a high asset turnover, which can compensate for it.

Summary:

Return on asset surely talks about earnings. However, it is not necessarily that the company with a high ROA actually earns a lot of profit. There are more to ROA than just assets and returns.

Source

- Gitman, Lawrence J., and Chad J. Zutter. Tenth Edition. Principles of managerial finance

- https://www.investsmart.com.au/investment-news/roa-asset-turnover-and-margins/50461

- https://tradefromhome.org/why-return-on-assets-are-so-important-for-investors/

- https://smallbusiness.chron.com/companies-high-asset-turnover-low-profit-margin-76515.html

- https://www.thebalance.com/asset-turnover-357565

- https://www.nibusinessinfo.co.uk/content/importance-assets-business

- https://www.fool.com/investing/general/2011/09/29/low-margin-companies-are-still-compelling.aspx