The P2P Lending Industry

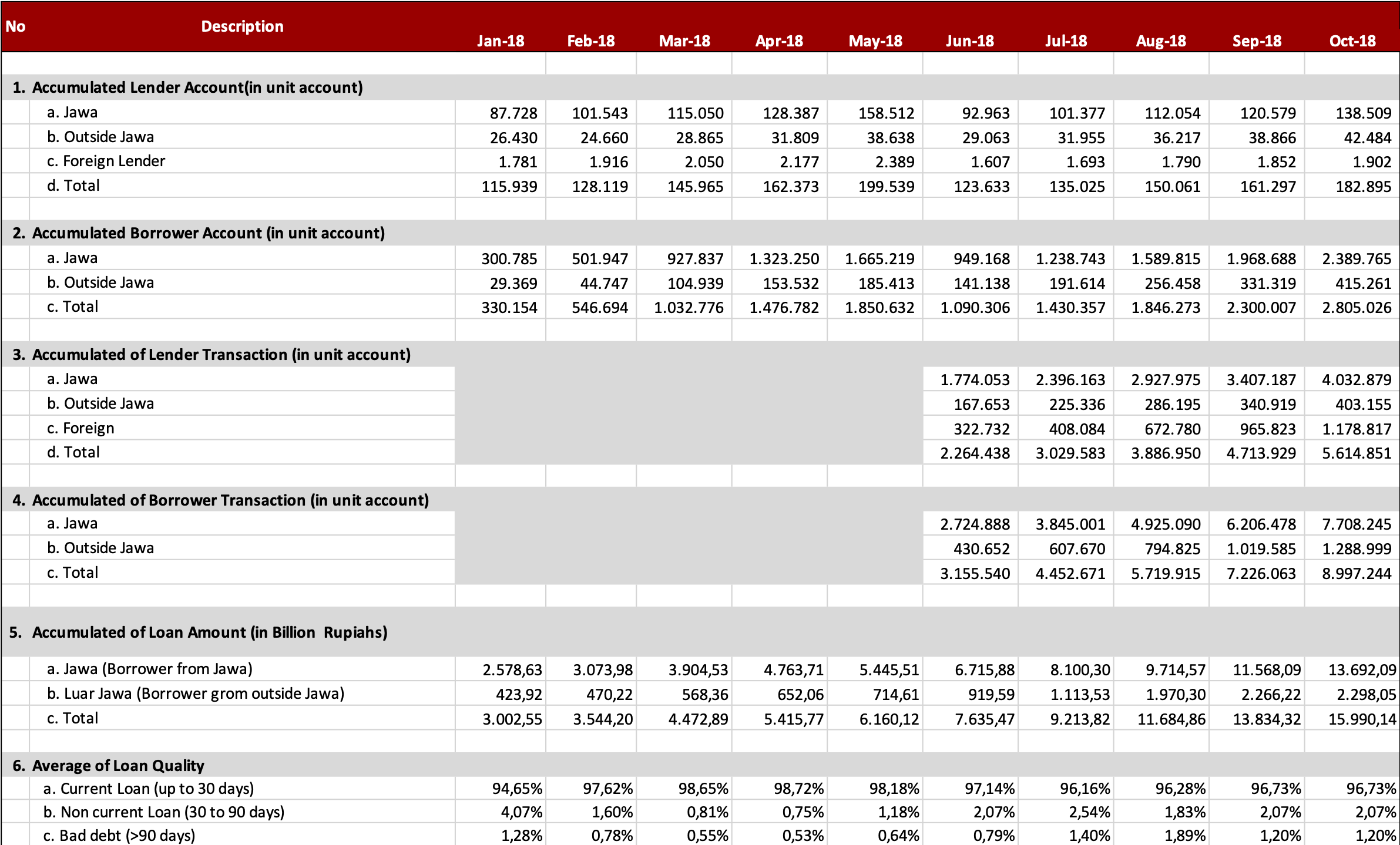

During 2018, the industry of Lending Services based on Information Technology (Peer to Peer –P2P) in Indonesian shows rapid progress. Data from the Financial Services Authority (OJK) shows accumulated P2P credit by early October 2018 has reached 15.9 trillion rupiahs. It increased more than 450% compare to the beginning of the year and in addition, the bad debt ratio is maintained at 1.2%. Moreover, the number of licensed or registered organizers for P2P activity at OJK has reached 78 companies. We can see the monthly growth of P2P Lending industry at the table below :

Observing the significant growth of the P2P Lending industry, it appears that the existence of P2P Lending will disrupt the banking industry. Is it true?

What is P2P Lending?

Basically, P2P is a financial service institution that provides a platform to bring debtors and creditors together. By utilizing the technology, P2P offers the convenience of money lending and borrowing services. However, this convenience does not necessarily make P2P compete or even replace the role of banking. As an intermediary institution, banks collect funds and then lent it, while P2P only acts as platform organizer.

Besides on fundamental differentiation on business activities, the total amount of credit and profiles of debtors in P2P and banking industry are also different. The amount of P2P loans is limited to a maximum of 2 billion rupiahs, it is stated on OJK Regulation Number 77/POJK.01/2016 regarding the Information Technology-Based Money Lending and Borrowing Services. Besides that, the profile of P2P debtors are individuals and SMEs who has not had access to banking.

There are two approaches concept of peer to peer lending (P2P Lending), the first one is as borrowers (debtor) and the other is as lenders (investors). People can choose whether they want to become a lenders by investing their money in P2P Lending platforms, or they can be borrowers who need loans for personal or business issues.

As an investor (lenders), there are some advantages offered by P2P Lending, one of it is a high investment return where the average P2P Lending company guarantee around 14-20% of return per year. Moreover, the investors will be given access to a complete information regarding the borrower’s profile with their level of risk that has been analysed and stipulated. Nevertheless, there are some risks that investors have to know. There is a possibility of an investment will be lost because the borrower failed to pay, and this will be entirely the responsibility of the investors because P2P Lending is only a platform which regulated by OJK. P2P Lending may not bear the risk or guarantee payments from borrowers. This possibility attempted to be minimized by P2P Lending by providing a complete and transparent information of the borrowers (debtors) and their levels of risk, furthermore its also provides protection fund or insurance options for investors.

As a borrowers, P2P Lending offers simplicity on process of credit proposal which is simpler compared to banks’ process, a compete interest rate compared to banks, and loan without collateral. However, the short-term loans is one of the disadvantages. Another weakness are, high interest of late or failed-paid loan, and the uncertainty of the exact amount of credit given because it’s depend on the investor approval.

Although there are many debates (pros and cons) on the P2P business process, we may see that P2P Lending industry shows significant growth and Indonesian government, in this case OJK, also monitor them periodically. It is depend on us as the society whether we want to choose the P2P Lending as an alternative investment, or we can choose it to borrow money in this platform, but we definitely have to carefully analyze and consider it in more detail.

References :

- www.detik.com : “menyongsong babak baru peer-to-peer lending”

- www.koinworks.com :”ketahui tentang peer-to-peer lending”

- www.duwitmu.com :”investasi return tinggi P2P lending”

P2P lending industry is really hype and it is very good prospect as we are facing Industrial Revolution 4.0. But i think government in Indonesia should really pay attention to illegal P2P lending.

curious about this platform, how about the respond of Indonesian? mmm

his is still new in Indonesia, hopefully it will be a new way to improve the economy for entrepreneurs, thanks for sharing

So it’s convenience money lending and borrowing platform. Thank you for sharing

It’s an interesting industry to think about.. nice info mas sammy