XL Axiata attracted investor to finance their cellular network expansion using SUKUK Ijarah

XL Axiata recently has actively expanded their network to accommodate the growth of its cellular network in terms of the number 3G and 4G services. The expansion include the additional 3G and 4G Base Transmitter Station, and also the Fiber Optic Transmission lines to expand the capacity of the cellular network. Thus expansion was triggered by the revenue growth as much as 0,4 % especially from data service which has significant increase of 13% compared to the same period last year. The significant increase of data service has contributed more to XL Axiata’s total revenue, from 69% at 2017 to 80% at year 2018. The significant increase of data service has compensate the revenue contribution decrease from voice service and traditional Short Messaging Service.

In order to finance their newest 2019 expansion, XL Axiata will get the fund from their SUKUK and Bond issuance. XL Axiata SUKUK and Bond has attracted the interest of society in Phase 1 and phase 2 2018. SUKUK and Bond has tenor between 370 days until 10 years with coupon between 8.25 % until 10.3 %. XL Axiata SUKUK Syariah or SUKUK Ijarah has gained AAA IDN rating from PT Fitch Ratings Indonesia.

What Is SUKUK Ijarah?

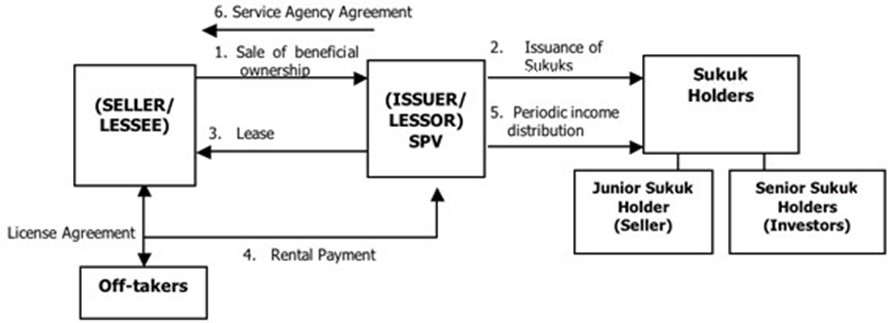

SUKUK ijarah is a SUKUK that is issued based on an agreement, in which one party acts alone or its representative sells or rents the benefit rights to an asset to another party based on the agreed price and period, without being followed by the transfer of ownership of the asset itself. Sukuk ijarah is the last product to grow rapidly in the capital market. The high demand by Islamic investors and financing institutions has caused the sukuk ijarah to grow. On the supply side there have also been many countries that have benefited from increasing the source of funds from fiscal needs and long-term financing of large development projects. The success of Sukuk issuance demonstrates XL Axiata’s commitment to further support the Government’s efforts in developing the Sharia Capital Market in Indonesia.

Earlier this year, PT XL Axiata Tbk. has completed the Public Offering of XL Axiata Phase II / 2019 I Sustainable Bonds and XL Axiata II Phase II / 2019 Public Sustainable Sukuk Ijarah Offering. XL Axiata Tbk (EXCL) cut the plan to issue bonds and sukuk with a maximum of Rp 2 trillion to Rp 1.27 trillion. The reason is the company has set the value of bond issuance of Rp 634 billion and sukuk worth Rp 640 billion.

XL Axiata management informed that it had completed the process of the second phase of the public offering (PUB) I in 2019. The company chose to release bonds worth Rp 634 billion with four series, a tenor of 370 days to 10 years, and a coupon rate of 7.9-10% per year.

Although it is not in accordance with the target of Rp1 trillion each (SUKUK and Bond), the issuer with the EXCL stock code ensures that the company is still able to fund a number of expansions planned this year. In yesterday’s (12-Feb-Trading) trading, EXCL shares closed down 2.82% to the level of Rp2,070. Throughout 2019, the share price rose 4.55%. Meanwhile, in the past 1 year, the stock has been corrected to 27.62%. The company’s market capitalization is currently valued at Rp22.12 trillion.

Source:

https://www.cnbcindonesia.com/market/20190206163100-17-54110/geliat-ekspansi-capex-excl-diprediksi-rp-8-9-t https://market.bisnis.com/read/20190213/189/888232/rekomendasi-saham-xl-axiata-excl-layak-koleksi https://id.beritasatu.com/corporateaction/rilis-obligasi-dan-sukuk-xl-axiata-tetapkan-nilai-rp-127-triliun/185230